Table of Content

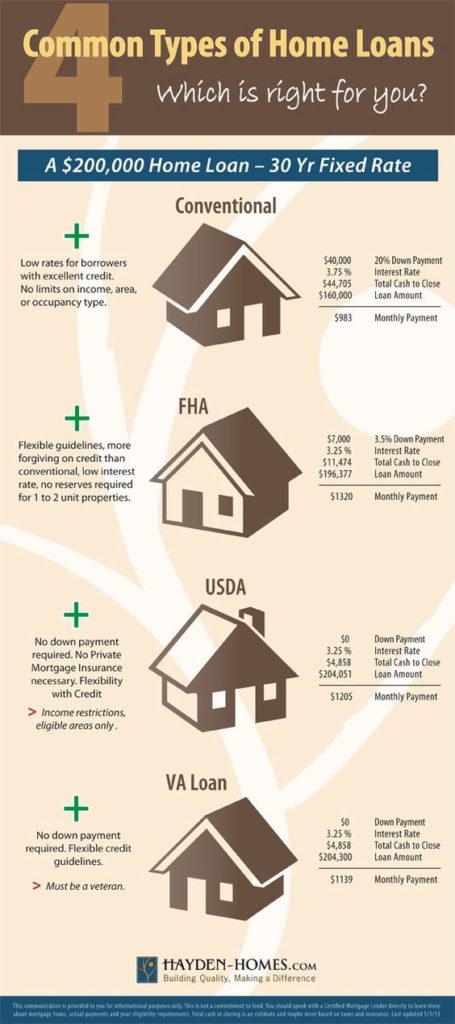

The answer to this question depends on a variety of factors including your credit score, employment history, and the amount of money you are looking to borrow. The best way to find out if you will qualify for a mortgage loan is to speak to a loan officer at your bank. They will be able to review your financial situation and let you know if you are likely to be approved for a loan. FHA guidance allows lower credit scores, which is one reason first-time home buyers are often attracted to FHA loans. The FHA lets borrowers with credit scores as low as 500 be considered for home loans.

After you submit a loan application, the lender must provide a Loan Estimate within three business days. Once you’ve provided these basic pieces of information, the lender will request supporting financial documents to verify your income, savings, and debts. You can see a list of supporting documents you’ll be asked for below. If you prefer to go it alone, on the other hand, there are a wide variety of lenders that will let you complete most or all of the mortgage process online. If you have a current copy of your personal credit report, simply enter the report number where indicated, and follow the instructions provided. If you do not have a current personal report, Experian will provide a free copy when you submit the information requested.

About Chase

So, before pursuing an FHA loan, take an inventory of your financial health to ensure that an FHA loan is right for you. An FHA loan is an excellent tool for people who want to enjoy home ownership but don't have great credit or a significant sum of money saved up for making a down payment. Borrowers are required to have a debt-to-income ratio of less than 43 percent. Borrowers with a credit score of 500 to 579 have to pay 10 percent down. FHA loans are a good alternative if a borrower doesn't have enough savings to make a sizeable down payment or their credit isn't very good.

To help homebuyers, the FHA allows some closing costs to be rolled into the mortgage and paid over time. You’ll want to take all the costs of homeownership into account. This includes loan payments, mortgage insurance, property taxes and Homeowners Association fees. Make sure you can afford all of this on top of your existing debt and bills.

FHA property requirements

This protects the lender in case you are unable to repay your loan. Borrowers can qualify for an FHA loan with a down payment as little as 3.5% for a credit score of 580 or higher. The borrower’s credit score can be between 500 – 579 if a 10% down payment is made. It’s important to remember though, that the lower the credit score, the higher the interest borrowers will receive. Your credit score can significantly impact the minimum down payment you can make on your FHA loan. However, in order to qualify, you must have a FICO score of at least 500, which allows you to secure the loan with a 10% down payment.

This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions.

MIP (Mortgage Insurance Premium)

The loan must be for a principal residence, and at least one borrower must occupy the property within 60 days of closing. You may initiate an FHA loan application online, over the phone, or in person. FHA loans are insured by the Federal Housing Administration, an arm of Housing and Urban Development commonly known as HUD. Those whose mid-FICO scores are below 580 but not lower than 500 may still be eligible for an FHA-insured loan as long as they have at least 10% to put down.

Even if a borrower can meet particular prerequisites, a lender is under no obligation to approve a loan before the established FHA waiting period ends. Bankruptcy does not disqualify a borrower from mortgage assistance but will delay the process. In most cases, applicants must wait a minimum of two years from the discharge date of their bankruptcy, not the filing date.

Texas FHA Loans

Prequalifying for a loan simply means that you have taken an inventory of your income and assets and submitted them to your potential lender. Based on that information you should be able to qualify for a home mortgage loan. It is customary for lenders to examine the most recent statement 60 days after it has been issued. As a result, if you’ve been providing bank statements every month, the lender will need to see them from the previous six months.

Furthermore, borrowers must have a debt-to-income ratio of 43 percent or lower, and those who put less than 20 percent down must obtain mortgage insurance. You don't need to be a first-time home buyer to get an FHA loan. Credit challenges and saving up for a down payment can be big hurdles for first-time home buyers. Loans that are insured by the FHA have lower down payment requirements than conventional loans and tend to be a more affordable option for first-time homebuyers. However, even an FHA loan has fees and extra costs that need to be factored into your monthly mortgage payment. It’s designed to keep the loan process transparent by providing information about a borrower’s estimated interest rate, monthly mortgage payments, and closing costs upfront.

You can also check with the Better Business Bureau to review a bank or mortgage lenders rating and read online reviews. Your down payment doesnt have to come from your own funds either. The down payment can come as a gift from a family member, employer or approved down payment assistance group. FHA loans also allow for a non-occupant cosigner to help the borrower qualify for the loan. However, many lenders now allow you to apply for an FHA loan online as well. Your loan officer can then review your FHA loan application and let you know if other information is needed, which you can conveniently submit from home.

Since FHA loans allow you to put down as little as 3.5%, they're an option for homebuyers who haven't been able to set aside a significant sum. FHA loans help you buy a home with limited credit or a reduced down payment. Learn how to qualify for an FHA loan and what to expect when you apply. A governmental agency or public entity with a program providing homeownership assistance to low- or moderate-income families or first-time homebuyers.

When applying for an FHA loan, you should consider the ratio of your net worth to your income. It is not unusual to pay mortgage interest at a rate higher than 31% of your monthly income. The ratio of your back-end debt includes mortgage payments and other obligations.

The highest DTI the FHA allows is 50%; that's if your credit score is at least 580 and you meet additional qualifications. Not only might they have different qualifications, but you can also weigh different lenders' rates and fees. Lenders often times will steer their clients away from an FHA loan due to their inexperience with the program. We share our knowledge and experience with FHA loans, making it easier for borrowers.

The mortgage rate you are offered is primarily determined by your credit score, how much debt you have, where you live, your down payment, and the size of the loan you are applying for. FHA loans are generally more affordable than conventional loans, according to mortgage lenders. If you have a poor credit score and are looking to buy a home, an FHA loan may be a good option. The best features of a government-backed home loan from the FHA include lower down payments, closing costs, credit score qualifications and interest rates. Compared to a conventional loan, one that the government does not guarantee, an FHA loan has fewer requirements. You'll need a better credit score, a lower debt-to-income ratio and a larger down payment to qualify for a traditional loan.

No comments:

Post a Comment